Let’s Start By Learning What is Peppol Network?

Peppol, also short for Pan-European Public Procurement Online, is an international network developed as a standard for the European Union. The network plays a key role in ensuring that all documents sent and received through it are electronically and securely exchanged between buyers and sellers listed within the network’s scope, whether the transmission is between private or public sectors.

The network originated from Europe and slowly defeated geo-restrictions as the standard got recognition from different countries, regions, including the United Arab Emirates UAE. By managing e-documents via the Peppol network, participants ensure a smooth issuance and sharing process according to a set of rules and standards managed by OpenPeppol; a non-profit international association.

What is Peppol CTC?

We explained Peppol, but what is Peppol CTC? Let’s dig deeper. CTC stands for Continuous Transaction Controls. This is a framework developed by OpenPeppol to monitor how businesses within the network report transactions that happen.

The CTC framework ensures that businesses report their transactions in real-time or near-real time. Why is it important? The Peppol CTC method relies on real-time data collection, rather than retroactive audits. This is vital for eliminating delays and empowering governments to fight fraud attempts as they occur.

Understanding The Difference: CTC And “Peppol CTC” (DCTC Model)

CTC (Continuous Transaction Controls)

The Continuous Transaction Controls (CTC) framework is a method that the government uses to collect invoices in real-time or near-real-time reporting. It can be centralized where invoices will have to go through a single official platform, where the key points are the sender, receiver, and the government’s system (3 corners), similar to how it’s done in Italy. In other words, it’s implemented according to the strategy the government chooses.

Or Decentralized

Another type of CTC is Decentralized Continuous Transaction Controls (DCTC); which is what Peppol uses. In this model framework, businesses send and receive transactions through Peppol accredited service providers known as Access Points (APs) not through a single central platform. Documents in this model are exchanged through APs and reported simultaneously to the government, making it a 5 corner model (sender, receiver, sender AP, receiver AP, and government).

The Term “Peppol CTC”

When saying “Peppol CTC”, we refer to the 5-corner model that follows the DCTC framework. It’s important to understand that Peppol CTC is different from other types of CTC models like the one practiced in Italy as aforementioned.

“Peppol’s CTC” model always follows a decentralized framework as it’s Peppol-network-governed; whereas other CTC models are not Peppol-Network-restricted and can be centralized according to each government’s specific strategy.

“Peppol CTC” is the specific name for Peppol’s own version of the model. The term was created to clearly distinguish its decentralized, 5-corner model from other models. Both CTC and DCTC, however, ensure e-documents like invoices are shared in real-time or near real-time.

Peppol’s 4-Corner Model vs The 5-Corner Model

The 4-Corner Model

It’s a standard electronic exchange of documents through the Peppol network; however; it doesn’t happen in real-time. It follows a decentralized framework where the transmission of documents, such as invoices, happens between businesses through what is known as APs or Access Points, with no reporting to a fifth party like the tax authority.

The name 4-corner model comes from the parties involved to make the transaction process happen and they can be defined as follows:

- Corner 1: The sender, the business that is willing to send the e-document or invoice through their internal software (like ERP, accounting system, or invoicing system).

- Corner 2: The Sender’s Access Point (AP), this is the accredited service provider that the sender relies on to connect to the Peppol’s network to send their e-documents. Without the sender’s AP, the sender can’t share their documents with other parties inside the network. The sender’s software sends the document to the sender’s AP in a standardized format. Upon validating the document by the sender’s AP, the AP shares it within the Peppol network.

- Corner 3: The Receiver’s Access Point (AP), This is the certified service provider used by the recipient. It receives the document from the sender’s Access Point.

- Corner 4: The Receiver, the business that receives the document. The receiving business only gets the e-document once their access point provider has validated it and delivered it into their internal software for processing.

The decentralized nature of the 4-corner Peppol model facilitates the exchange of documents through the network without having to go through a single or central hub like a tax authority. This helps in creating a secure and open network where businesses can easily send and receive a document through their Access Point Providers (APs). The accredited service providers of the sending and receiving points handle the technical process.

The 5-Corner Model – Peppol CTC

That said, the 5-corner model can be considered as an extension of the 4-corner model, but with the addition of a fifth corner, like the tax authority. It follows a decentralized framework of the Continuous Transaction Controls (CTC) model. In the Peppol CTC Model, the transaction is shared through the network between the 4 corners, but is simultaneously also reported to the fifth corner (tax authority or government).

Key Difference From The 5-Corner Model

In the 4-corner model, the main goal is to ease the exchange process of documents through the Peppol network via sender, receiver, and Access Point Providers, with no real-time reporting to a fifth corner. In other words, no CTC model is required here. The transmission happens directly from one accredited AP to another.

A Quick Recap

The “Peppol CTC” is a special CTC Model that aims to provide a harmonized, interoperable solution for businesses and tax administrations listed within the Peppol network. It provides compliance for businesses by globally recognized standards, while giving tax authorities greater visibility and control over transactions; a win-win model for all parties involved.

The Continuous Transaction Control (CTC) Model is not exclusive to Peppol as it can be adapted according to each government’s preferred method (can be centralized or decentralized). The DCTC Model, however, is Peppol’s own framework for CTC, which is also known as “Peppol CTC” or “5-corner Model” and it can be considered as one of several approaches to CTC models implemented worldwide.

For a Peppol model to be considered a DCTC model, it must have 5 corners. The fifth corner is the tax authority, which receives a real-time report of the transaction. If the model only has 4 corners, it’s simply a standard Peppol e-document exchange between businesses, without real-time reporting to the tax authority. So, the presence of the fifth corner is what makes it a “Peppol CTC” model.

Keep reading as we demonstrate cases from the Middle East on both models: CTC & DCTC.

Implementation of The CTC Model in The Middle East – KSA

The E-invoicing implementation in the Kingdom of Saudi Arabia – under what ZATCA has called the FATOORAH platform – can be considered as a strong example of the CTC (Continuous Transaction Control) model. Specifically, as a clearance model. Let’s explain how.

The Saudi model is a bit different as it implements two different methods according to the invoice type, B2B or B2C. The Saudi model operates on a principle that requires government validation through a central point, but for B2B transactions, it follows a clearance model, whereas in B2C, it doesn’t. Both invoices, however, have to be sent to the FATOORAH platform in real-time or near real-time (24 hours).

Here’s How it Works As A CTC Centralized Clearance Model – B2B Invoices

Real-Time Validation (Clearance):

For business-to-business (B2B) transactions, a business must submit its e-invoice to ZATCA’s platform for validation before sending it to the buyer. The platform validates the invoice’s format and content and applies a cryptographic stamp. Only after this “clearance” is the invoice considered legally valid.

Central Platform:

The approach relies on a central government platform, the ZATCA FATOORAH portal, which all taxpayers must integrate with. This platform acts as the central point of clearance.

A Dual Approach – B2C Invoices

The system has a slightly different approach for B2C transactions (business to consumer), which follows a real-time reporting model. The invoice is generated and shared with the customer first, but the data must be reported to ZATCA within 24 hours.

Implementation of The DCTC Model in The Middle East – UAE

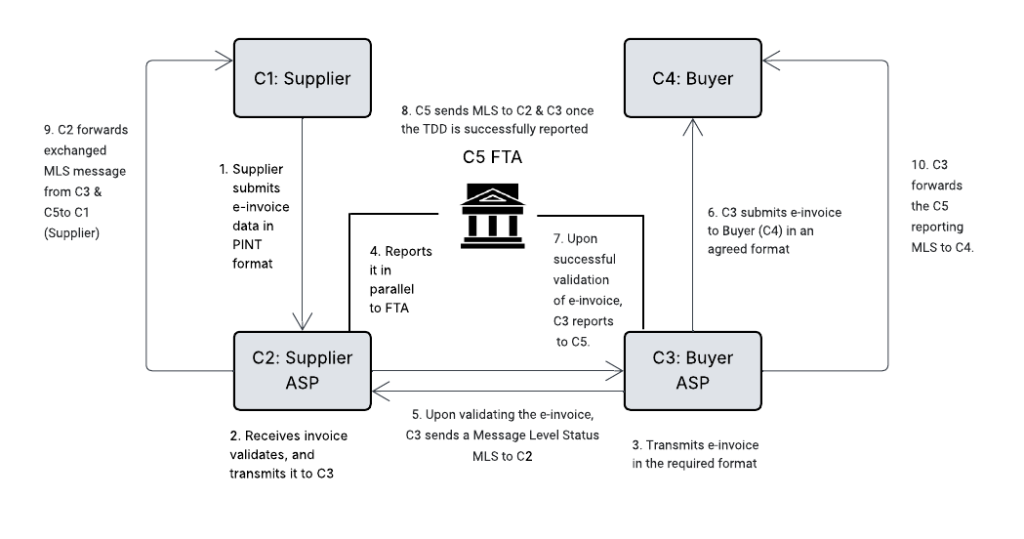

The United Arab Emirates has decided to follow the same framework as Peppol CTC, also known as the 5-Corner Model, for its e-invoicing method. The UAE e-invoicing model has been called the DCTCE Model (Decentralized Continuous Transaction Controls Exchange).

Decentralized:

In this model, it requires the 5 essential corners that include (sender, receiver, sender AP, receiver AP, and the FTA as the fifth corner). This model is decentralized because it serves as a perfect example of the Peppol CTC framework, which doesn’t rely on a specific single governmental platform for e-invoicing, similar to the one implemented in Saudi Arabia (FATOORAH). Instead, businesses are required to use what the UAE calls ASP or Accredited Service Provider, which is referred to as AP or Access Point in the Peppol network, to exchange (send & receive) the documents.

Continuous Transaction Controls:

The system will include real-time or near-real-time reporting to the Federal Tax Authority (FTA) through each party’s accredited service provider via the Peppol network.

UAE DCTCE Model: UAE’s Implementation of The 5 Corner Model

The UAE model is considered a direct implementation of the Peppol 5-corner Model, which is also known as DCTC. However, the UAE model is called “DCTCE” which stands for Decentralized Continuous Transaction Control and Exchange.

This specific term is used to describe the UAE’s version of the Peppol 5-corner model. The “E” for “Exchange” emphasizes that the model doesn’t only involve continuous reporting to the FTA (the “Control” part) but also facilitates the direct and secure exchange of invoices between all parties involved (B2B & B2G).

If the validation of the e-invoice is unsuccessful (before step7), C3 reports a negative Message Level Status (MLS) to C2 as well as to C5. Which means no reporting of the TDD to C5 by C3.

Simple Peppol Discovery Workflow: The SML and SMP

The Service Metadata Locator (SML) and Service Metadata Publisher (SMP) are also core parts of the Peppol network to ensure the document exchange process between access points happens correctly by finding businesses. They work together like a central directory and a subdirectory to ensure the document is received safely by the endpoint.

What Happens When A Business Registers?

1. Getting Listed in The Central Directory (SML):

The business’s SMP location is registered with the central Peppol directory, SML. This is the master list that knows where to find every individual SMP.

2. Address in The Network (SMP):

The business or its Peppol-accredited service provider sets up a directory called an SMP. This directory lists the business’s unique ID and the types of documents it can receive (like invoices).

What Happens When A Business Sends A Document?

1. The Search:

A sender’s system (AP) has the recipient’s Peppol business ID and is trying to locate them.

2. Asking The SML:

The sender’s system (AP) queries the SML first by using the recipient’s business ID. The SML’s only job is to return the exact web address of the recipient’s SMP.

3. Getting Details From The SMP:

The sender’s system (AP) then goes to that SMP address to get the final details, such as where to send the document and what formats the recipient can accept.

4. Send the Document:

With all the right information, the document is sent directly to the recipient’s system.

Data Standardization Methods: PINT – BIS – UBL

Data standardization ensures a set of rules and specifications exist to manage electronic business documents, including but not restricted to invoices within the Peppol network. They affirm that the exchanged document data is structured in a consistent way.

Why does this matter?

Standardization is deemed crucial for business interoperability. In simple English, finding agreed-on methods by which different computer systems can communicate with each other to automatically process a document, regardless of the software or country.

Let’s break down the main data standardization methods, as they are terms you hear or will be hearing about a lot.

1. What is UBL?

UBL stands short for Universal Business Language. It is a global standard used for electronic business documents (including but not limited to invoices). The UBL data standard has been developed by OASIS. These documents are structured using XML (Extensible Markup Language) to ensure smoother reading and processing of e-documents by computers.

How is it Connected To Peppol?

Peppol does not implement UBL directly for the electronic documents shared over the network. Instead, it implements what is called BIS (Business Interoperability Specifications), which happens to be built based upon the UBL data standard.

Therefore, UBL can be considered as the foundational data standard Peppol relied on to set its standards for the electronic documents shared over its network after adding specific additional rules and constraints.

Think of it this way: A BIS electronic document is a UBL electronic document, but with specific rules for fields and values that comply with Peppol’s defined requirements.

2. What is BIS?

BIS stands for Business Interoperability Specifications. This is the technical data standard that Peppol follows and implements for its electronic documents. It defines how the electronic documents (not restricted to invoices) should be structured and formatted when exchanged while using the Peppol network. It’s like the language Peppol documents use to ensure any type of software is capable of reading them. Originally, it was developed for transactions in Europe.

3. What is PINT?

PINT stands for Peppol International Invoice. It is a newer and a more simplified version of BIS that can be globally used for e-invoicing only. In other words, it doesn’t include different electronic business documents like BIS.

PINT was developed by Peppol to address the limitations BIS had for electronic documents of invoice type to give it a global user reach. The original BIS invoice was too specific to European requirements, such as tax rules and other regional needs.

PINT stepped in to figure out these regional limitations by providing a more streamlined standard that can be more easily adapted by different countries worldwide. Thus, it became the foundational standard for e-invoicing of Peppol in various regions, including the UAE.

PINT is for e-invoices, while BIS and UBL are for all types of e-documents

Conclusion

We covered the core concepts of Peppol, including its foundational decentralized 4-corner model, and its extension into a 5-corner model for real-time reporting within a DCTC framework like that of the UAE. Explained some core concepts to help distinguish between the two terms “centralized” and “decentralized”.

Navigating the world of e-invoicing can seem complex, but understanding the core concepts of Peppol CTC, and the standardized data language of PINT, BIS, and UBL, and how each one of them relates to the other helps us understand the process better.

For Businesses in The UAE,

The transition to the new DCTCE mandate is a significant step toward a more efficient and compliant future, and choosing a reliable partner is crucial for a smooth transition. Luckily, InvoiceQ is a Peppol-accredited service provider (AP), specifically equipped to help businesses in the UAE comply with the upcoming e-invoicing mandate.

Our platform simplifies the entire process, ensuring your business can seamlessly connect to the network, exchange invoices securely, and meet all real-time reporting requirements to the FTA. With InvoiceQ, you can confidently embrace the future of e-invoicing.